How Home Insurance Can Protect Against Warm Weather

|

Mar 27, 2024 - By the dedicated team of editors and writers at Newsletter Station.

|

As the climate changes, warm weather events like heatwaves, wildfires, and severe storms become more frequent and intense. These extreme weather conditions can pose significant risks to your home and property. While most people associate home insurance with protection against traditional perils like fire, theft, or water damage, it's essential to understand that a good home insurance policy can also safeguard your property against warm weather-related risks.

In this blog post, we will explore how home insurance can protect your home and assets from the impacts of warm weather events.

- Coverage for Wildfires

In regions prone to wildfires, the threat of a fire destroying your home can be a constant worry. Home insurance typically provides coverage for damages caused by wildfires. This coverage can help you rebuild or repair your home if it's damaged or destroyed by flames. It may also cover the cost of replacing personal belongings damaged or lost in the fire. However, checking your policy's terms and limits is essential, as coverage for wildfires may vary based on your location and the insurance company.

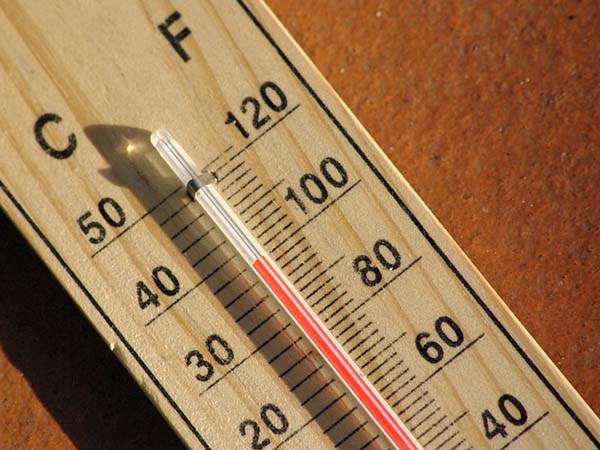

- Protection Against Heat-Related Damage

Warm weather can lead to various types of damage to your home, including heat-related issues like roof damage and air conditioning system failures. Most home insurance policies cover roof damage caused by covered perils, including heatwaves and windstorms. If your air conditioning system fails due to a power surge or other covered perils, your insurance may cover the cost of repairs or replacement.

- Coverage for Storm Damage

Warm weather can bring severe storms that produce strong winds, heavy rain, and hail. These weather events can significantly damage your home's roof, siding, windows, and other structures. Fortunately, standard home insurance policies typically cover damage caused by storms and their associated perils, such as wind and hail. If a severe storm damages your home, your insurance can help cover the cost of repairs or replacement.

- Liability Protection

Warm weather often leads to more outdoor activities and gatherings, increasing the likelihood of accidents on your property. If someone is injured while visiting your home during a warm-weather event, your home insurance liability coverage can help protect you. It can cover medical expenses, legal fees, and other costs associated with a liability claim, giving you peace of mind during those summer barbecues or pool parties.

- Additional Living Expenses Coverage

If your home becomes uninhabitable due to warm weather-related damage, such as wildfire or storm damage, your home insurance policy may include coverage for additional living expenses. This coverage can help pay for temporary housing, food, and other essential expenses while your home is being repaired or rebuilt.

Warm weather can bring both joy and challenges to homeowners. While we enjoy the sunshine and outdoor activities, it's essential to recognize the potential risks that come with it, such as wildfires, storms, and heat-related damage. Home insurance serves as a valuable safety net, providing financial protection and peace of mind when facing the unpredictable nature of warm weather events.

To ensure adequate coverage, reviewing your policy, understanding its terms and limits, and considering any additional endorsements or riders necessary for your specific location and needs is crucial. With the right home insurance in place, you can better protect your home and assets against warm weather impacts.

Unlock the Power of Email Marketing

Harness the potential of email marketing with Newsletter Station. Reach your target audience, drive conversions, and achieve your business goals.

|

More Blogs

| Apr 24, 2024 |

Navigating the Road: Understanding Auto Insurance for Classic Cars

|

| Apr 17, 2024 |

Safeguarding Your Drive: The Importance of Liability Insurance on Your Vehicle

|

| Apr 10, 2024 |

Protecting Precious Possessions: When and Why to Insure Your Jewelry

|

| Apr 3, 2024 |

How Traffic Tickets Can Affect Your Auto Insurance Rate

|

| Mar 27, 2024 |

How Home Insurance Can Protect Against Warm Weather

|

| Mar 20, 2024 |

How Your Driving Record Affects Your Car Insurance

|

| Mar 13, 2024 |

Understanding Uninsured Motorist Coverage: Protecting Yourself on the Roads

|

| Mar 6, 2024 |

Understanding Auto Insurance: Liability vs. Full Coverage

|

| Feb 28, 2024 |

Filing an Insurance Claim When Your Home Experiences Water Damage

|

| Feb 21, 2024 |

Mold and Homeowner's Insurance: What to Know

|

| Feb 14, 2024 |

Understanding the Implications of an At-Fault Car Accident

|

| Feb 7, 2024 |

Things That Are Not Covered by Your Homeowner's Insurance

|

|

|

|